ITR REFUND STATUS: The Income Tax Department is going to return the extra amount of tax money to those taxpayers who paid more than they needed to. The taxpayers have to fill up the income tax refund form to ask for the return. The refund status can be checked online on the ITR website.

Taxpayers should keep track of their refund status once they submit the ITR. Once you submit the request, the officials will check the necessary documents and will decide whether you are actually eligible for the refund or not.

The refund will be transferred to the personal bank account of the taxpayers. It can take a few days or even more than a month. The income tax return process is currently going on.

If you want to know more about ITR Refund Status 2023-24, ITR refund, how to check the status? Time, why my income tax refund is not done yet, and other relevant information about ITR 2023 24, you need to read the article till the end. We have discussed all of your queries about ITR 2023-24 and even more.

ITR Refund Status 2023-24

The Income Tax Department will refund the tax to those taxpayers who submitted more than the essential amount. 31st July 2023 was the last date to file for the income tax return process. After that, taxpayers had to pay an extra amount of fee for a late appeal.

Now the ITR process is going on. The taxpayers who have filed for the tax return should keep an eye on the official website to know about their ITR refund status 2023- 24.

ITR Refund Status: How long will it take?

The taxpayers who have already applied for the ITR are eagerly waiting to get their money back. The taxpayers will only be able to see their ITR status after 10 days of filing the application. There is no specific timeline for the ITR return. It can take a few days or even more than a month.

But mostly, the refund is made from 15 to 30 days after filing the appeal. The money will be directly transferred to the personal bank account of the taxpayer. But the process may take even longer than that as a lot of taxpayers have applied for the same.

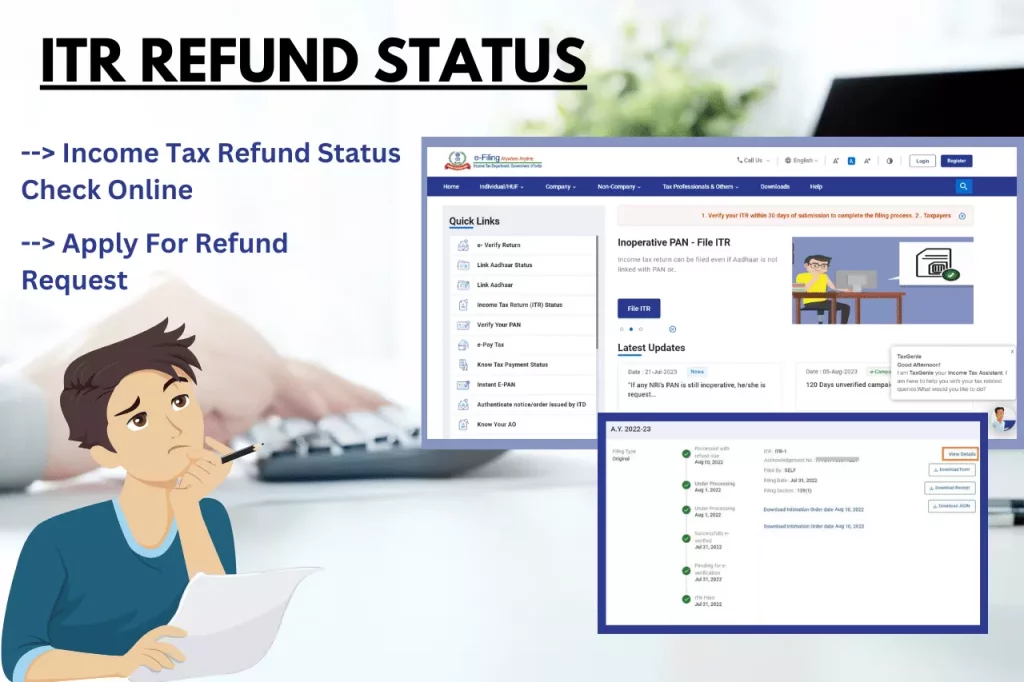

How do I check ITR Refund Status 2023-24?

The taxpayers can check their refund status after 10 days of filing the appeal. They need to log in with their User ID, Date of Birth, and Password to log into their account. To know your status, you need your PAN card number.

You can check the status via the Income Tax E-filing Site or the TIN NSDL site. We have listed the guidelines below on how to check your status in both ways. Read the process below to learn more.

How to Check ITR Refund Status Via Income Tax E-filing Site?

Step 1:

Visit the Official Portal of the Central Income Tax E-filling site.

Step 2:

Now you need to enter your User ID, Password, Date of Birth, or DOI (Date of Incorporation) to log into your account. You can also use your unique PAN or Aadhar Card number in place of your User ID.

Step 3:

Once you are done entering these details, enter your security pin code carefully, as mentioned on the page, and click on submit.

Step 4:

Now you will be redirected to a new page where you need to search for ‘My Account’ Option.

Step 5:

Find the ‘Refund Status’ option and click on it.

Step 6:

Your ITR refund status will be visible on your screen.

How to Check ITR Status Via TIN NSDL Site?

- Go to the official website of TIN NSDL.

- Enter your PAN card Number and your year of Assessment.

- After entering the details, enter the security pin code and log into your account.

- Now you will be able to see your ITR refund status on the screen.

How to get ITR Refund by Credit Card and Cheque?

After the taxpayers file the appeal, the officials will verify all the information to check whether they are indeed eligible for a refund or not. If everything is okay, then the money will be transferred into the personal bank account of the taxpayer.

You need to give details, including your Bank Account number, Branch Name, Code, and IFSC Code, to get the refund. If by any chance the details of your bank account are wrong or unclear, the money will be refunded by cheque.

How can I Request For ITR Refund Reissue?

If your ITR refund process is not successful for any reason, you will get a chance to raise a refund reissue request. You need to appeal from the official website for that.

- Firstly visit the official website of the Income Tax E-filing Site.

- Then enter your User ID, Password, and Date of Birth in the given space. You can also enter your unique PAN card number or Aadhar number to log into your account.

- Enter the security pin code as mentioned on the screen and submit.

- Now A page will open. Search for ‘My Account’ and click on the ‘Service Request’ button.

- Now select the ‘ New Request’ option.

- Now select the ‘refund reissue’ option on this page.

- Select the year of your assessment and proceed further.

- Enter your bank details, including Branch Name, Code, and IFSC Code, and click on submit.

Why Have I Not Received My ITR Refunds Yet?

ITR Refund can take more than normal time for a lot of reasons. Though it’s tough to tell why you haven’t received your payment yet, here is a list of some common reasons that can delay your refund.

Wrong/ Invalid Information:

While filing your ITR Application, make sure that you have entered your bank account details and other personal details correctly. Unclear or Wrong Information can cause a delay in receiving the refund. Also, sometimes the information needs to be checked manually. In that case, it takes longer than usual.

Calculation Errors:

While appealing for your tax return, if you have made any mistake in the calculation, like a deduction or addition in the credit or didn’t attach the required documents, it can delay your refund process.

Identity Verification of Taxpayer:

The Income Tax Department sometimes conducts extra verification if they suspect the taxpayer’s identity has been messed with or it’s a fraud case. The verification process can take a long time, causing delays in refunds.

High Traffic:

A lot of people have filed for ITR refunds. Check the documents of the Official needs a longer time. High Traffic can be one of the most reasonable causes for delay in ITR Refund.

IMPORTANT LINKS:

| Official Website | CLICK HERE |

| Our Homepage | CLICK HERE |

FREQUENTLY ASKED QUESTIONS ABOUT ITR REFUND STATUS 2023-24

How can I check my ITR Refund Status 2023-24?

You can check Your ITR Refund Status 2023-24 on the Income Tax E-filing Website or TIN NSDL Site. Enter your User ID, DOB, and Password to log in. You can use your PAN number or Aadhar number instead of your User ID to log into your account too.

How long does ITR Refund Take?

There is no specific timeline for the ITR Refund. But generally, it takes 15 to 30 days. However, in the case of High Traffic, it can take longer than that.

What does ‘No Demand No Refund’ mean on my ITR Refund Status?

It means all of the details provided by you are correct, and your documents have been checked correctly. But you are not eligible for the ITR Refund.